Texas Reverse Mortgages

Reverse Mortgage Programs

Reverse Mortgages in Texas

A reverse mortgage or HECM (Home Equity Conversion Mortgage) is a financial tool that allows homeowners ages 62 and older to convert part of their home equity into cash payments and/or a line of credit. Since there are no restrictions on how the proceeds can be used, many reverse mortgage borrowers use HECM to:

- Purchase a new home

- Pay medical bills

- Move closer to family members

- Travel

- Supplement retirement income

There are many advantages to HECM products for seniors today. These options allow homeowners to remain homeowners without having to make monthly mortgage payments. Homeowners can choose between a lump sum payment, a line of credit, or a guaranteed monthly payment. Medicare payments are not affected.

Contact us to discuss your options and decide what program works best for you.

*Homeowner must continue to pay property taxes, required insurance and any applicable HOA fees.

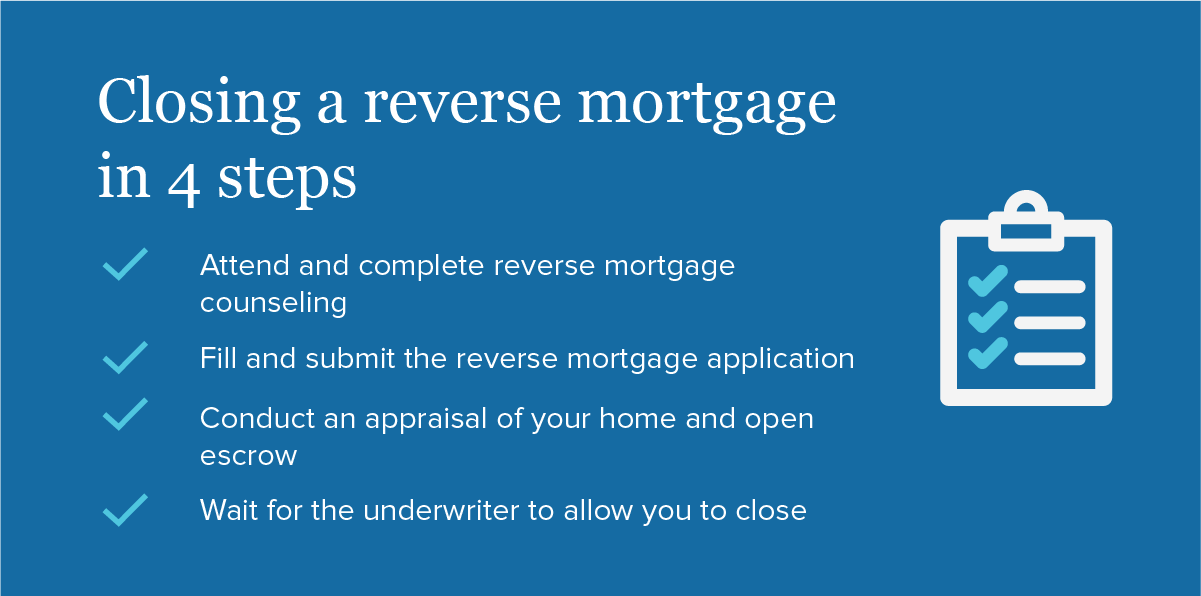

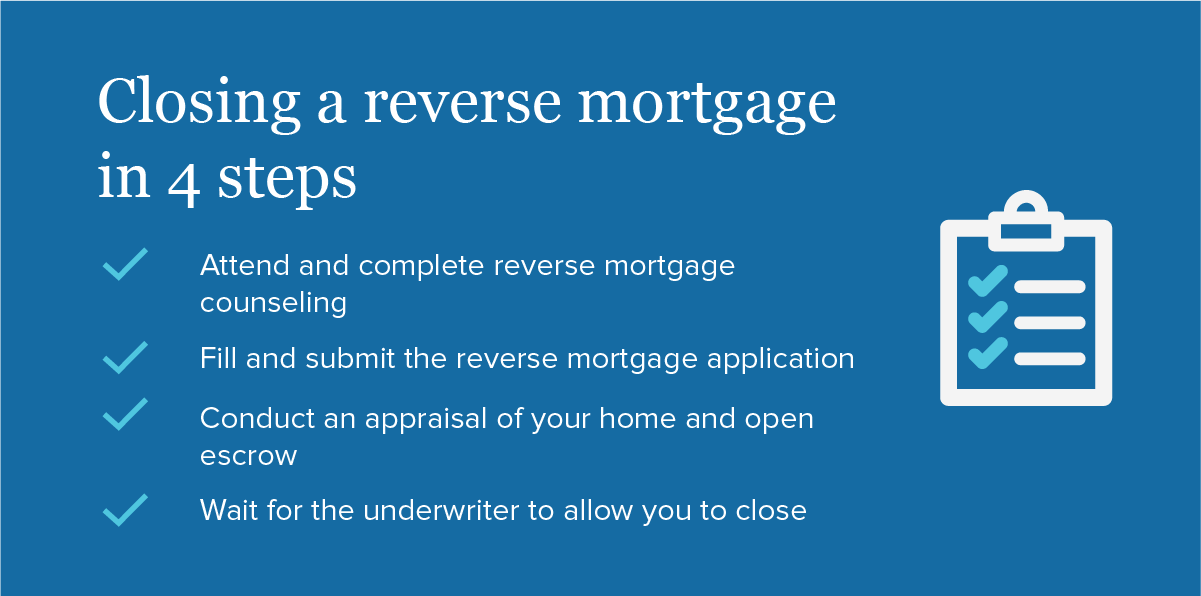

Reverse Eligibility:

- 62 years or older

- Must live in home as primary residence; vacation homes and investment properties do not qualify

- Complete a HUD-approved counseling session

- Must be able to pay homeowners taxes, insurance, and any applicable HOA fees

What is a reverse mortgage?

A reverse mortgage is a loan that allows older homeowners to borrow against the equity in their homes.

When to use a Reverse mortgage?

Older homeowners looking to access their home’s equity by converting that equity into cash. Reverse mortgages are special because the payout to the borrower for equity comes in either a lump sum or monthly payments to them.

What is home equity and how is it calculated?

Home equity is the value of the homeowner’s interest in their home. Home equity is calculated by looking at the current market value after any liens on the property are subtracted.

“HECM” is the most popular reverse mortgage in Texas

What is HECM? “HECM” stands for “home equity conversion mortgage.” This is the most common type of reverse mortgage in Texas.

For a home equity conversion mortgage, the following requirements apply:

- The homeowner (applicant) must be at least 62 years old,

- The home must be the homeowner’s principal residence,

- The homeowner must own the home outright or have a low mortgage, and

- The balance of the mortgage can be paid off at closing with proceeds from the reverse mortgage loan.

Texas Reverse Mortgage Loans

Speak to a Loan Officer - Quick Rate Quote

"*" indicates required fields