Texas FHA Loan Requirements

Texas FHA Loan Guidelines & Qualification Requirements

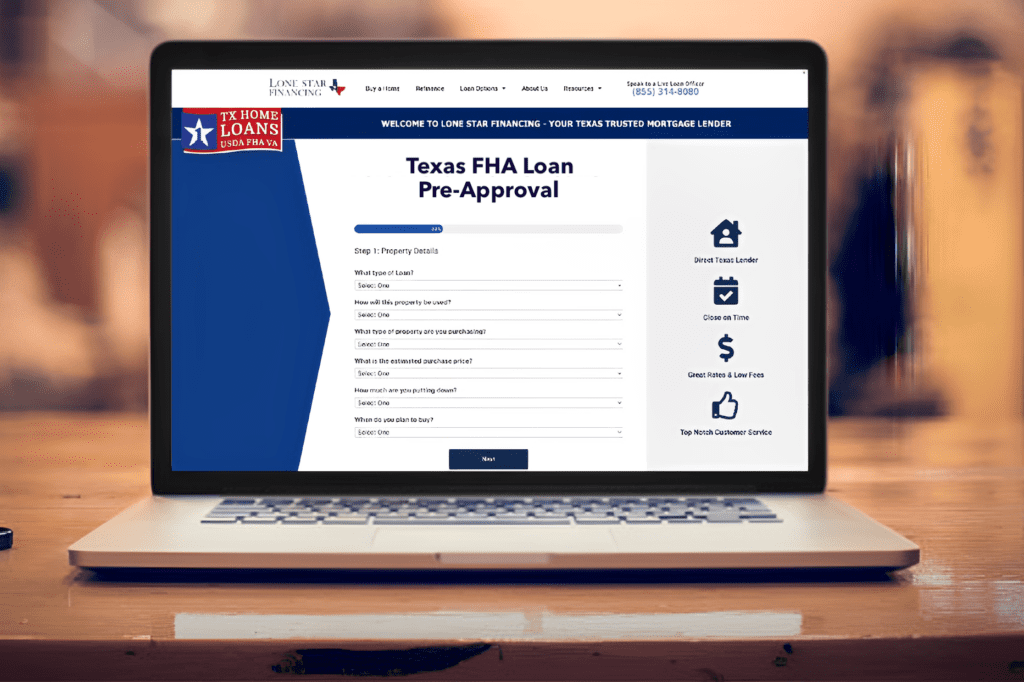

Welcome to Lone Star Financing – We are an approved FHA lender in Texas with low rates, flexible credit requirements, and in-house underwriting for fast approvals.

With competitive rates and a focus on customer satisfaction, we make FHA loans accessible and affordable for first time home buyers in Texas.

FHA LOAN QUALIFICATIONS

To qualify for an FHA loan, you’ll need to meet the following requirements.

- Stable employment/income

- Minimum FICO 600

- Must be primary residence

- 50% or lower debt to income ratio

- Minimum 3.5% down payment

- Money to cover the upfront mortgage insurance premium (UPMIP)

First Time Home Buyers

Minimum FICO Credit Score

600

Minimum Down Payment

3.5%

Maximum Loan To Value

96.5%*

Maximum Debt To Income

50%*

Mortgage Insurance

Yes

Years Since Bankcruptcy

2

Years Since Foreclosure

3

Years Since Short Sale

3

Special Qualification Requirements

NONE

Texas FHA Loan Qualifications

- Credit Score & Down Payment: 580+ credit score = 3.5% down; 500–579 = 10% down.

- DTI Ratio: Preferably ≤50%, but higher may be accepted with strong financials.

- Property Requirements: Must be a primary residence and meet FHA standards.

FHA Requirements

FHA loans in Texas are great loans for helping first-time buyers and those with lower credit scores secure affordable and hassle free home financing.

Why Lone Star Financing

Lone Star Financing offers competitive FHA loan options with attractive rates, streamlined approvals, and personalized guidance throughout the process.

Our local Texas mortgage experts take the time to understand your goals, explain FHA requirements clearly, and provide responsive support from application to closing—so you can move forward with confidence.

Close on Time

Our goal is to close every loan in 30 days or less.

Low Rates

Texas FHA loans with Low Rates, Low Fees and Fast Closings.

Service

FHA loans in TX with top-notch customer support.

FHA Requirements in Texas

- Minimum credit score of 580 for maximum financing (3.5% down payment required).

- Borrowers with credit scores between 500 and 579 may qualify but need a 10% down payment.

- Minimum down payment of 3.5% of the purchase price for those with credit scores of 580 or higher.

- Down payment can come from personal savings, a gift from a family member, or a grant.

- Typically, a maximum DTI of 43% is allowed.

- Some lenders may allow a higher DTI with compensating factors like a large cash reserve.

- Proof of steady employment and income over the past two years.

- Verification through W-2s, tax returns, and recent pay stubs.

- The property must be used as your primary residence.

- FHA loans are not available for investment properties or second homes.

- The home must meet minimum property standards set by the FHA.

- An appraisal by an FHA-approved appraiser is required to assess the property’s value and condition.

- An upfront MIP (usually 1.75% of the loan amount) is required.

- An annual MIP is also charged and paid monthly as part of the mortgage payment.

- FHA loan limits vary by county in Texas.

- In Texas, FHA loan limits for 2026 are $541,287.

- Must have a valid Social Security number and be a legal resident of the U.S.

- Generally, you should be at least two years out of bankruptcy and three years out of foreclosure.

- Must have re-established good credit.

Lone Star Financing is an approved lender in Texas for FHA home loans. Call to speak to a licensed loan officer to learn more about FHA loan qualifications and requirements.