First-Time Home Buyers in Texas

Financing Options for First-Time Texas Homebuyers

FHA loans are a great option for first-time homebuyers, but you don’t need to be a first-time buyer to qualify.

Unlock your Texas dream home with FHA loans—featuring low down payments and flexible credit guidelines that make homeownership more accessible. View FHA Requirements: FHA.com/requirements

First-Time Home Buyer Loan Benefits:

- Down Payment – Only Down 3.5%

- Down Payment Gift Funds Allowed

- Seller paid closing costs up to 6%

- In-house Flexible Underwriting

- Higher Debt-to-Income Ratios OK

- Lower Credit Scores OK

- 600 credit scores OK with 3.5% Down (can include gift funds)

$541,287 MAX VALUE

Stable monthly payment with less money down

Minimum FICO Credit Score

600

Minimum Down Payment

3.5%

Maximum Loan To Value

96.5%*

Maximum Debt To Income

55%*

Mortgage Insurance

Yes

Years Since Bankcruptcy

2

Years Since Foreclosure

3

Years Since Short Sale

3

Special Qualification Requirements

NONE

Texas FHA Loan Highlights

- 2026 loan limits: $541,287

- Minimum down 3.5%

- Minimum FICO >600

First-Time Buyer FHA Loans

FHA loans offer Texas homebuyers a more accessible path to ownership with low down payments and flexible credit standards. These government-backed loans are a popular choice for first-time buyers. We’re here to guide you through every step of the process.

Questions about buying your first home in Texas? Speak with an FHA specialist.

| Guide to First Time Buyer Home Loans in Texas

An FHA first-time buyer loan is a mortgage backed by the Federal Housing Administration designed to help new homebuyers, especially those with lower credit scores or limited savings, access affordable financing. It typically requires a lower down payment and has more flexible credit requirements than conventional loans, making homeownership more accessible.

Here are some common requirements for first-time homebuyer loans in Texas:

- Minimum Credit Score: Typically around 580 for FHA loans (or higher for other loans).

- Down Payment: As low as 3.5% for FHA loans; other programs may vary.

- Debt-to-Income Ratio: Generally should be below 43%, though some programs allow higher.

- Stable Income and Employment: Consistent income over the last two years.

- Property Requirements: Must be a primary residence and meet safety standards.

For 2026, the FHA loan limit for a single-family home in Texas is $541,287, with higher limits for multi-unit properties.

For many first-time buyers in Texas, the required down payment may be lower than you think. FHA loans require as little as 3.5% down with a qualifying credit score. Conventional loan options may allow down payments starting at 3% for eligible borrowers.

In addition, down payment funds can often come from gift funds, savings, or approved assistance programs, helping reduce your out-of-pocket costs. Our team will review your financial profile and show you the lowest down payment option available based on your goals.

Yes — many first-time buyers in Texas are surprised to learn they can still qualify with less-than-perfect credit. FHA loans are built for buyers with moderate scores, and as a mortgage broker, Lone Star Financing can often secure approval with FICO scores as low as 580, depending on overall qualifications.

Beyond your credit score, most of our lenders evaluate income stability, debt-to-income ratio, and payment history. If your score needs improvement, we can outline practical steps to strengthen your approval profile and help you move forward confidently.

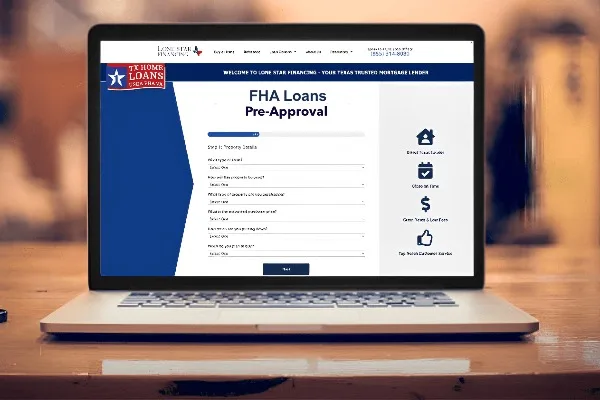

Get Prequalifed Today!

Start Your Pre-Approval Online

GOODTrustindex verifies that the original source of the review is Google. I worked with Jen Papaelias at Lone Star Financing and I cannot rave enough about her. She went above and beyond to make sure that I was able to purchase my dream home. The few minor bumps we had, she was able to help us work to get them fixed. Lone Star Financing will be the first suggestion I give everyone when looking to purchase a home!Posted onTrustindex verifies that the original source of the review is Google. Extremely knowledgeable, efficient and best customer care .Posted onTrustindex verifies that the original source of the review is Google. I've had the pleasure of working with Brett Dempsey and his team over the years and he provides a first class service with the customer always in mind.Posted onTrustindex verifies that the original source of the review is Google. Jen made our first home mortgage process easy and stress-free! She was extremely responsive, explained everything clearly, and helped us secure a great rate. Jen answered all our questions promptly and made sure we understood every detail before closing. Her professionalism and expertise were invaluable for first-time buyers. Highly recommend Chien for anyone looking for a reliable and knowledgeable loan officer!Posted onTrustindex verifies that the original source of the review is Google. Outstanding experience with LoneStar Mortgage, thanks entirely to Brett. He did a phenomenal job from start to finish. His knowledge, creativity, and experience made all the difference, especially when challenges arose. He handled everything with confidence, professionalism, and genuine care. Him and his Team were absolute pleasures to work with and truly went above and beyond. We could not have completed this process without them. Highly recommend Brett D to anyone looking for an exceptional mortgage opportunities.Posted onTrustindex verifies that the original source of the review is Google. Brett is so helpful! Quality service! Can't recommend enoughPosted onTrustindex verifies that the original source of the review is Google. I don't typically write reviews but I wanted to acknowledge the excellent service from this company, in particular Chien was knowledgeable, responsive, and a pleasure to work with!Posted onTrustindex verifies that the original source of the review is Google. I highly recommend Chien at Lone Star Financing. Chien is very knowledgeable, patient and efficient. She was always available when we needed to contact her, and secured us a great rate.Posted onTrustindex verifies that the original source of the review is Google. amazing service from Lone Star Financing! Chien was knowledgeable, responsive, and made the mortgage process effortless. always knew what was happening and felt in great hands. Highly recommend!!!