Texas Mortgage Pre-Approvals

Quick Online Home Loan Pre-Qualification Process

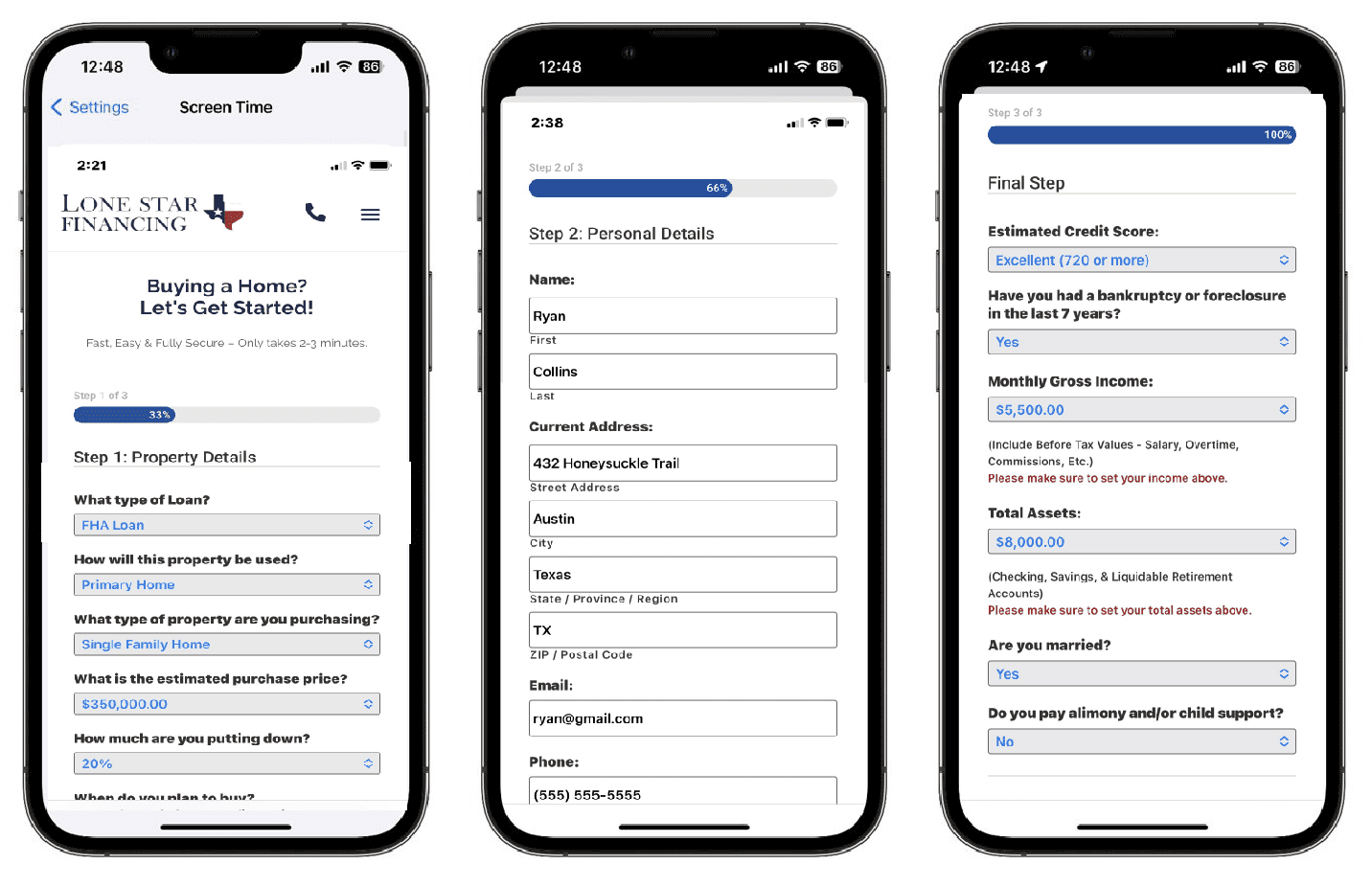

Apply for a Home Loan in Texas - Made Easy as 1, 2, 3

Same Day Pre-Approvals

- Provide Your Loan Details.

- Share a Few Personal Details

- Schedule Appointment with Loan Officer

Same Day Pre-Approvals

Lone Star Financing makes it easy to apply for home loans in Texas. We specialize in FHA home loans, VA loans, Conventional loan, Jumbo mortgages, and Refinance Options — low rates, fast closings and exceptional customer service.

- FHA, VA & Jumbo Loans

- Access to Wholesale Pricing

- Fast Approvals

- Low Rates & Fast Close

- Texas Customer Service!

Jump in Front of the Line - Get Pre Qualified Today

Getting a mortgage pre-approval before shopping for a home helps you understand your budget and strengthens your position as a buyer. It show that you’re a serious and qualified buyer, which can give you and advantage in competitive markets. Additionally, it helps avoid surprises by identify any potential issues with your credit or finances early in the process.

Get pre-qualified before you fall in love with your dream home. Here are a few reasons why it’s important to get pre approved for your next Texas mortgage before you go home shopping:

- Know Your Budget: Pre-approval gives you a clear idea of how much you can borrow, helping you shop within your price range.

- Stronger Negotiating Power: Sellers are more likely to take your offer seriously if you have pre-approval, as it shows you’re financially qualified.

- Avoid Surprises:

Pre-approval uncovers potential issues with your credit or financial history, allowing you to address them early. - Saves Time: Focus your home search on properties you know you can afford, streamlining the buying process.

- Faster Closing Process: With pre-approval in place, you can move through the mortgage process more quickly once you’ve found a home.

- Locked-in Interest Rate: Some lenders allow you to lock in an interest rate during pre-approval, potentially saving you money if rates rise later.

- Sellers Prefer Pre-Approved Buyers In a competitive market sellers prefer offers from pre qualified buyers

- Realtors Prefer Approved Home Shoppers: Some realtors require buyers to get pre-qualified before even working with clients.

About Lone Star Financing

Lone Star Financing is a Texas mortgage lender offering fast closings and quick pre-approvals. With in-house underwriting and same-day approvals, we make it easy to get pre-qualified and start your home purchase with confidence. Apply online in minutes—we look forward to earning your business.

Home Loan Pre Qualifications in Texas - Easy as 1, 2, 3!

Apply Online

Upload Docs Securely

Get Approved!

Apply for a Home Loan Today Same Day Pre-Approvals

Get started by completing our quick, secure online pre-qualification form. It’s an easy first step toward homeownership and helps estimate how much you may qualify for—before you start shopping for homes.

Many Realtors request pre-qualification before a home search. A pre-qualification letter helps you focus on the right properties and keeps the mortgage process moving smoothly.

Check Your Credit

Before You Prequalify

Lenders assess your payment history, income, and current debts to gauge how likely you are to make consistent loan payments. The numerical representation of your creditworthiness is your credit score, a key factor in mortgage approval.

You can easily check your credit report and score for free on many websites, such as Free Credit Report and Credit Karma.

If your score is below 640, it’s worth reviewing your report for accuracy.