VA Home Loan Specialists Serving Texas Veterans

Lone Star Financing is a trusted Texas VA loan partner, proudly serving veterans with affordable home financing and competitive VA loan options.

Lone Star Financing is a trusted VA-approved lender in Texas, helping veterans and active-duty service members buy or refinance with a simple, stress-free process.

VA LOAN QUALIFICATIONS:

- Military Service: Active duty service, or eligible National Guard or Reserve member

- Discharge Status: Must have received an honorable discharge

- Service Length: 90 days of wartime service or 181 days of peacetime service

- Spousal Eligibility: Surviving spouses of veterans who died in service or from a service-related disability may also qualify

- 2026 Loan Limits $832,750: standard VA loan limits for most Texas counties

$832,750 MAX VALUE

Minimum FICO Credit Score

620

Minimum Down Payment

0%

Maximum Loan To Value

100%*

Maximum Debt To Income

41%*

Mortgage Insurance

NO

Years Since Bankcruptcy

2

Years Since Foreclosure

2

Special Qualification Requirements

Must be U.S. Veteran

VA loans in Texas remain one of the most flexible mortgage options available to eligible veterans and service members statewide.

Texas VA Loan Benefits

- No Down Payment: Texas VA loans offer eligible veterans zero down and no PMI.

- No Loan Limits with Full Entitlement: Eligible veterans with full VA entitlement may borrow without loan limits.

- Lower Interest Rates: VA loans provide lower rates compared to other loans

Your Trusted VA Lender for Texas Veterans and Active-Duty Service Members

Lone Star Financing is a preferred VA lender in Texas because we shop multiple lenders to secure competitive rates and flexible approvals for eligible veterans. As a mortgage broker, we match your financial profile to the right VA loan program and guide you from pre-approval to closing with clear, streamlined support.

Questions about Texas VA loans? Speak with a VA expert today.

Allen Lundberg

Sr. Loan Officer

NMLS #277507

Chris Lederer

Production Manager

NMLS #2004549

Jen Papaelias

Sr. Loan Officer

NMLS #2692859

Ryan Wood

Sr. Loan Officer

NMLS #1757471

Brett Dempsey

Branch Manager

NMLS #2014728

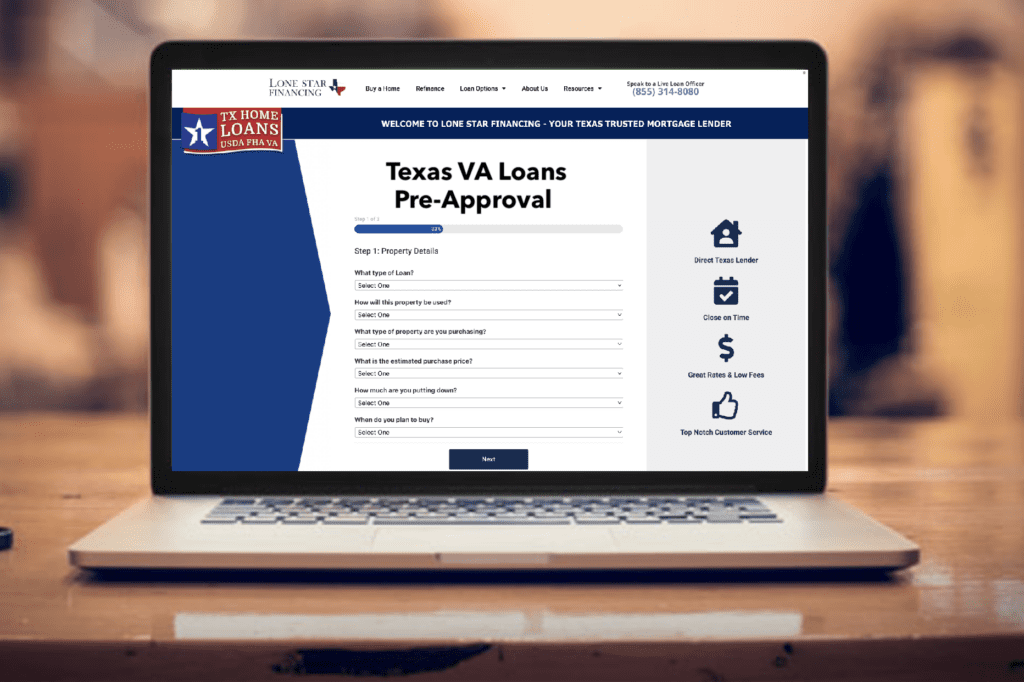

Get Prequalifed Today!

Start your mortgage pre-approval online!

| Guide to Texas VA Loans

Texas VA mortgages offer several advantages for eligible veterans, active-duty service members, and their families. One of the biggest benefits is the option for zero down payment, which significantly reduces the upfront costs of purchasing a home. Texas veteran loans provide unbeatable benefits, including zero down payment, competitive interest rates, and no private mortgage insurance, making homeownership more accessible and affordable than ever.

A few highlights for VA Loans in Texas:

- Lower Rates

- 2026 Loan Limits $832,750

- TX VET Program Available

- Easier Qualifying

- Alternate Credit OK

- 4% Seller Concessions

- No Prepayment Penalties

- Funding Fee can be Financed

- Manufactured Housing OK (subject to restrictions)

Texas VA loans also come with competitive interest rates and no private mortgage insurance (PMI) requirement, potentially lowering overall monthly payments. Additionally, the program provides flexible credit requirements, making homeownership more accessible to those with varied credit histories.

Benefits of a VA Home Loan

VA home loans offer a range of benefits, including the ability to purchase a home with zero down payment and competitive interest rates, which can significantly reduce your upfront costs and monthly payments. With no private mortgage insurance (PMI) required, you’ll save even more over the life of the loan.

- No Down Payment: One of the most significant benefits is the ability to finance up to 100% and have zero down payment. We offer Zero down 100% Finance Options.

- No Private Mortgage Insurance (PMI): Unlike conventional loans, VA home loans do not require PMI, which can save you hundreds of dollars each month.

- Competitive Interest Rates: VA loans often come with lower interest rates compared to conventional loans in Texas, which can result in lower monthly payments and less money spent over the life of the loan.

- No Prepayment Penalties: You can pay off your VA loan early without prepayment penalties.

- Credit Requirements: At Lone Star Financing we can go down to 620 FICO for Texas VA loans. This is a much lower credit qualification than other loans in Texas.

- Assumable Loans: VA loans, much like FHA loans, are assumable, meaning that if you sell your home, the buyer can take over your existing VA loan, which could be a great selling point.

Additionally, VA loans come with flexible credit requirements, making homeownership more accessible, and feature protective measures against foreclosure. These advantages make VA home loans an exceptional choice for veterans, active-duty service members, and their families looking to secure a stable and affordable home.

What is a Texas VA Loan?

A VA home loan is a benefit provided by the U.S. Department of Veterans Affairs (VA) and are backed by the government, which means they come with many advantages for borrowers. Texas VA home loans are a mortgage option specifically designed for eligible veterans, active-duty service members, and their families in the state of Texas. With flexible credit requirements and favorable terms, Texas VA home loans are a valuable tool for those who have served or are currently serving in the military, helping them achieve homeownership with fewer financial hurdles.

- Zero Down Payment: VA home loans typically require no down payment, reducing the initial cost of purchasing a home.

- Competitive Interest Rates: Often lower than conventional loan rates, saving you money over the life of the loan.

- No Private Mortgage Insurance (PMI): VA loans do not require PMI, which can lower your monthly payments.

- Flexible Credit Requirements: Easier credit standards compared to conventional loans, making homeownership more accessible.

- No Prepayment Penalties: You can pay off your loan early without incurring additional fees.

- Assumable Loans: VA loans can be transferred to a new buyer if you sell your home, potentially making your property more attractive to buyers.

- Foreclosure Protection: The VA offers support and resources to help borrowers avoid foreclosure.

- Funding Fee: While VA loans don’t require PMI, a funding fee is often charged, but it can be financed into the loan amount.

Call or Apply Online Today to see why Lone Star Financing is one of the best VA Lenders in Texas.

Does Lone Star Financing offer VA refinancing in Texas?

Yes. Lone Star Financing offers VA refinancing options for eligible Texas veterans, including VA IRRRL (VA Streamline / VA EARL) and VA cash-out refinance programs.

What is a VA IRRRL or VA EARL refinance?

A VA IRRRL refinance, also called a VA EARL (Interest Rate Reduction Loan), allows Texas veterans to refinance an existing VA loan to lower their interest rate or monthly payment with minimal documentation.

Can I refinance into a VA loan with Lone Star Financing?

Yes. Eligible Texas veterans may refinance an existing VA loan through a VA IRRRL / VA EARL, or refinance a current mortgage into a VA loan using a VA cash-out refinance, subject to VA and lender guidelines.

GOODTrustindex verifies that the original source of the review is Google. I worked with Jen Papaelias at Lone Star Financing and I cannot rave enough about her. She went above and beyond to make sure that I was able to purchase my dream home. The few minor bumps we had, she was able to help us work to get them fixed. Lone Star Financing will be the first suggestion I give everyone when looking to purchase a home!Posted onTrustindex verifies that the original source of the review is Google. Extremely knowledgeable, efficient and best customer care .Posted onTrustindex verifies that the original source of the review is Google. I've had the pleasure of working with Brett Dempsey and his team over the years and he provides a first class service with the customer always in mind.Posted onTrustindex verifies that the original source of the review is Google. Jen made our first home mortgage process easy and stress-free! She was extremely responsive, explained everything clearly, and helped us secure a great rate. Jen answered all our questions promptly and made sure we understood every detail before closing. Her professionalism and expertise were invaluable for first-time buyers. Highly recommend Chien for anyone looking for a reliable and knowledgeable loan officer!Posted onTrustindex verifies that the original source of the review is Google. Outstanding experience with LoneStar Mortgage, thanks entirely to Brett. He did a phenomenal job from start to finish. His knowledge, creativity, and experience made all the difference, especially when challenges arose. He handled everything with confidence, professionalism, and genuine care. Him and his Team were absolute pleasures to work with and truly went above and beyond. We could not have completed this process without them. Highly recommend Brett D to anyone looking for an exceptional mortgage opportunities.Posted onTrustindex verifies that the original source of the review is Google. Brett is so helpful! Quality service! Can't recommend enoughPosted onTrustindex verifies that the original source of the review is Google. I don't typically write reviews but I wanted to acknowledge the excellent service from this company, in particular Chien was knowledgeable, responsive, and a pleasure to work with!Posted onTrustindex verifies that the original source of the review is Google. I highly recommend Chien at Lone Star Financing. Chien is very knowledgeable, patient and efficient. She was always available when we needed to contact her, and secured us a great rate.Posted onTrustindex verifies that the original source of the review is Google. amazing service from Lone Star Financing! Chien was knowledgeable, responsive, and made the mortgage process effortless. always knew what was happening and felt in great hands. Highly recommend!!!

Trusted Texas VA Lender

Lone Star Financing is a VA-approved lender in Texas, proud to serve those who have served our country. Whether you’re buying your first home or refinancing, we’re here to make the process smooth and rewarding.

Work with a licensed Texas VA Lender backed by experienced loan officers who understand VA loan guidelines in Texas.